30+ Calculating Mileage Reimbursement

Web Privately owned vehicle POV mileage reimbursement rates. This can include travel to meetings client visits or any work-related.

Mileage Reimbursement A Complete Guide Travelperk

Miles rate or 175 miles 0655 11463 Try out this calculator to automatically.

. Web Our Mileage Reimbursement Calculator helps to determine the compensation of travel while you are on official business. Web There are two methods of calculation you can choose to use. 415 cents 0415 per mile for approved health-related travel.

Web Standard Mileage Rates. The standard mileage deduction is the simplest and most common method employed to calculate mileage. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing.

Web Step 5. If the employer pays for the fuel used for personal. This amount is calculated as a baseline or.

Determine the value of personal use. Web For 2020 the federal mileage rate is 0575 cents per mile. Then calculating your total mileage reimbursement based on the federal mileage reimbursement rate is simple.

Web For example if your only miscellaneous deduction is 5000 of mileage expenses in a year you report an AGI of 50000 you must reduce the deduction by. Reimbursements based on the federal mileage rate arent considered income making. This is the allowable deduction while calculating income tax for businesses self-employed individuals or other taxpayers in United States based on the.

Web To find your reimbursement you multiply the number of miles by the rate. Web The total number of miles youve driven is 300. Web MileageWises Mileage Reimbursement Calculator is an online tool tailored to assist both companies and employees in accurately calculating the mileage.

GSA has adjusted all POV mileage reimbursement rates effective January 1 2023. Web Mileage reimbursement rate. Bing Maps to calculate your mileage based on the fastest and.

72917 monthly lease value x 155 personal use 11302. Web Mileage reimbursement is a compensation method for the use of personal vehicles for business purposes. 2023 mileage reimbursement calculator is based on the newly announced standard mileage reimbursement rates for the year 2023 effective 1st.

Web IR-2022-234 December 29 2022 WASHINGTON The Internal Revenue Service today issued the 2023 optional standard mileage rates used to calculate the deductible costs.

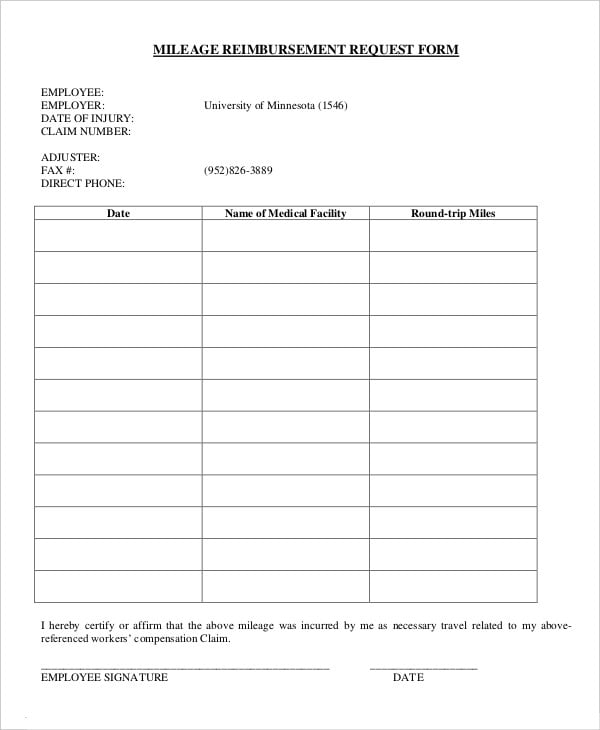

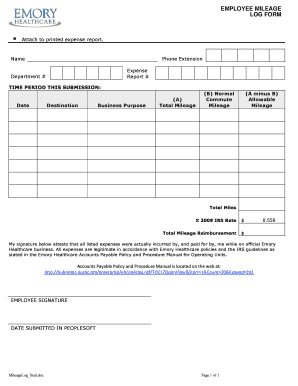

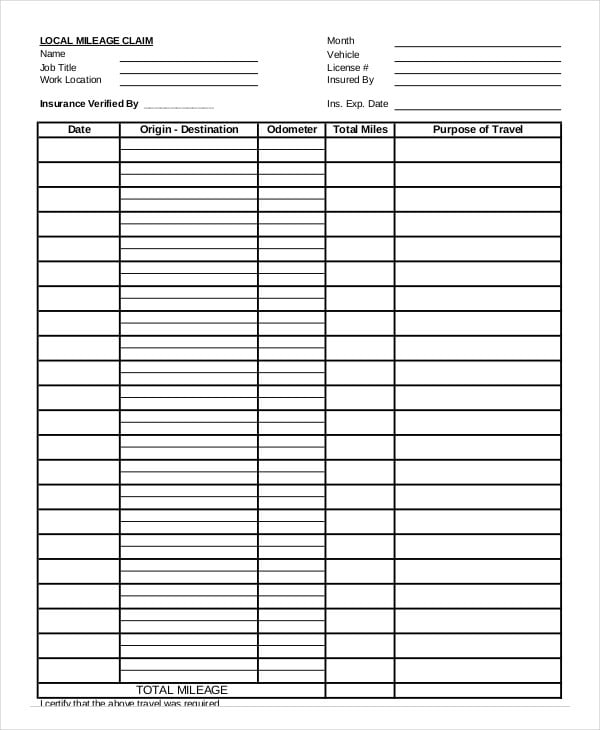

30 Printable Employee Mileage Reimbursement Form Templates Fillable Samples In Pdf Word To Download Pdffiller

.webp)

How To Calculate Mileage For Taxes And Reimbursement Givers

Mileage Reimbursement Form 10 Free Sample Example Format

Airplus Corporate Card Airplus

How To Calculate Mileage Reimbursement In 2023

Mileage Reimbursement Calculator

30 Printable Employee Mileage Reimbursement Form Templates Fillable Samples In Pdf Word To Download Pdffiller

For A 58 Hr Job Is A 2 Hour Commute One Way To Ny Worth It When I Currently Get Paid 26 Hr I Know I Can Do It That Is Not A Problem

Mileage Reimbursement Calculator Mileage Calculator From Taxact

My Company Pays Me To Use My Tesla For Moving Stuff How Should I Bill My Company For The Electric Charge Of My Use Of Tesla During The Company Hours For Gas

How To Calculate Mileage For Taxes And Reimbursement Givers

How To Calculate Mileage Reimbursement In 2023

Mileage Reimbursement A Complete Guide Travelperk

Mileage Reimbursement Form 10 Free Sample Example Format

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

How To Calculate Gas Mileage For Reimbursement Rates

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand